As the US dollar continues to strengthen, Asian currencies such as the Chinese renminbi will continue to weaken, analysts say.

As 2016 comes to a close, the divergence in monetary policies among the key central banks are widening. With the election of Donald Trump last month, there is much anticipation for higher interest rates in 2017. The Chinese currency has already fallen 7% against the dollar this year. According to Ministry of Commerce researcher Jin Bosong, the Chinese yuan will most likely further depreciate 3%-5% against the dollar next year.

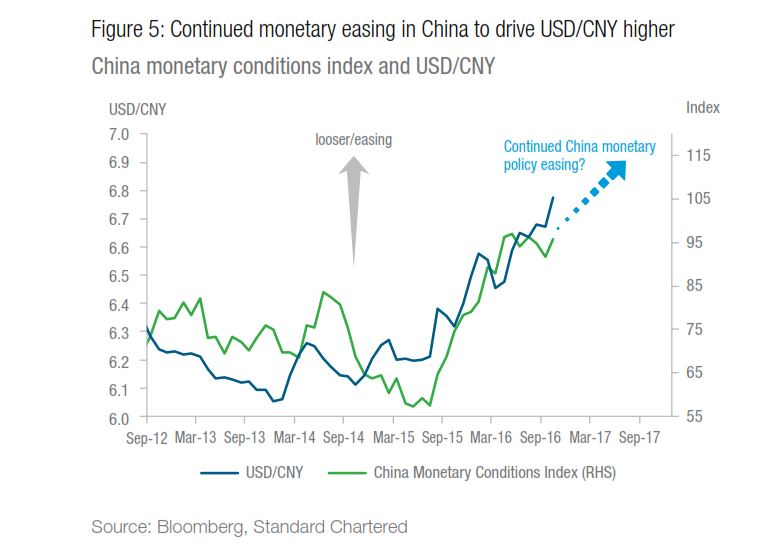

“We maintain our bearish outlook for the CNY heading into 2017. First, the impact from higher US rates and broad USD strength is negative. Higher US rates are likely to result in continued corporate deleveraging or capital outflow from China, which could pressure the currency,” highlights a recent Standard Chartered outlook report. “Second, we believe China is likely to maintain a broadly accommodative stance, which implies allowing the CNY basket to weaken in-line with market expectations.”

Aside from China, Southeast Asian countries such as Malaysia, the Philippines and Thailand stand to be affected by a strong dollar in 2017. According to Standard Chartered, Malaysia is the most susceptible towards the dollar. Already we have seen the Malaysian ringgit drop to levels not seen since the 1998 Asian Financial Crisis due to dual effects of the Trump election and the drop in oil prices over the past several months.

“We expect MYR weakness to extend heading into 2017. The MYR is one of the most sensitive regional currencies to USD strength, trade flows and commodity prices. Thus, the MYR is vulnerable in case of a regional currency sell-off due to a small current account surplus, the high foreign ownership of the local bond market and low FX reserve levels. A rise in commodity prices over the medium term could, however, limit MYR downside.”