Japan’s Government Pension Investment Fund (GPIF), the world’s largest pension fund, said the companies in which it invests are increasingly adopting environmental, social, and governance (ESG) considerations in their businesses.

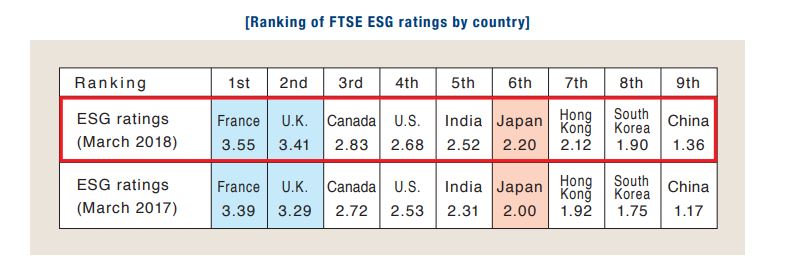

In the 12 months to March 2018, GPIF’s portfolio companies showed improved ESG rankings for both domestic and foreign equities. The pension fund measured changes in ESG evaluations of its portfolio by calculating the weighted average according to market capitalization of GPIF’s asset under management.

“ESG ratings, the ratings of all companies surveyed in the major countries, including Japanese companies, have improved,” says GPIF in a report.

“GPIF hopes that ESG evaluations of Japanese companies will improve further through enhanced responses to ESG issues and promotion of ESG disclosure,” it says.

According to the results of the analysis, the average ESG ratings of Japanese companies have remained lower than those of European companies in France and the UK. In terms of changes in ESG ratings, the ratings of all companies surveyed in the major countries, including Japanese companies, have improved.

Within Asia, equity portfolio from India showed the most improvement in the period, followed by Japan and Hong Kong.

Source: GPIF

GPIF, as an asset owner, aims to increase risk-adjusted return of its portfolio and improve the sustainability of whole financial markets. It wants to promote long-term returns by integrating ESG factors into its investment process.

GPIF created a ranking of the average ESG ratings of companies included in FTSE Global Equity Index by country in nine major countries/regions, and compared changes in rankings between March 2017 and March 2018.

GPIF, which has been placing greater emphasis on sustainable investing, recently announced it chose two carbon efficient indices compiled by S&P Dow Jones Indices as benchmarks for its ESG investment strategy.

GPIF says it invests 1.2 trillion yen (US$10.6 billion) domestically and abroad in passive funds tracking the indices and continues to engage in ESG investment.

The benchmarks – S&P/JPX Carbon Efficient Index and S&P Global Ex-Japan LargeMid Carbon Efficient Index – are structured to overweight companies that have high carbon efficiency and disclose their amount of carbon emissions.