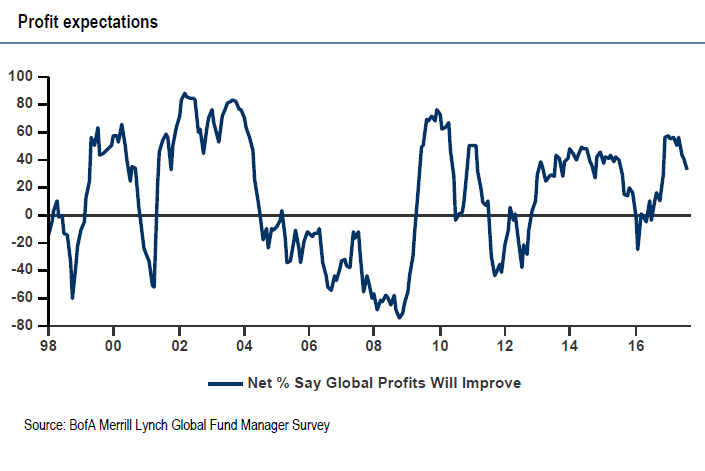

Fund managers’ expectations for corporate profits continue to drop along with those expecting a strong global economy, according to BofAML’s recent Fund Manager Survey.

Corporate profit expectations continued to drop, as a net 33% of the 202 fund managers surveyed say profits will improve over the next 12 months, down from 41% in July. Further, the percentage of fund managers expecting a strong global economy fell to 35% in August, down from 62% in January.

The survey found that fund managers remained broadly pro-risk and pro-cyclical, and were most consistently overweight banks, Eurozone, cash, and EM, and underweight the UK, energy, US, and bonds, relative to previous positions.

“Investors’ expectations of corporate profits have taken an ominous turn this year,” says Michael Hartnett, chief investment strategist, “which is a warning sign for equities over bonds, high-yield over investment grade, and cyclical sectors over defensive ones. Further deterioration is likely to cause risk-off trades.”

There was a record 42% of fund managers who expect a ‘goldilocks’ scenario in the next 12 months, meaning above trend growth and below trend inflation. However, a greater number of fund managers (46%) expected a secular stagnation of below-trend growth and inflation over the next 12 months.

The survey also found that fund managers’ average cash balance remained unchanged from July at a high of 4.9% above the ten-year average of 4.5%.

“Fund managers are holding on to cash at a stubbornly high level. Even so, European investors are positive on the growth outlook in the region but are moderating EPS expectations,” says Ronan Carr, European equity strategist.

Finally, fund managers considered the biggest tail risks to be a FED or ECB policy mistake (22%), followed by a crash in the global bond markets (19%), and North Korea (19%).