A further escalation in geopolitical conflicts remains the main concern of central bankers worldwide, and the situation is only likely to worsen if former US president Donald Trump wins the elections in the United States in November, a new survey finds.

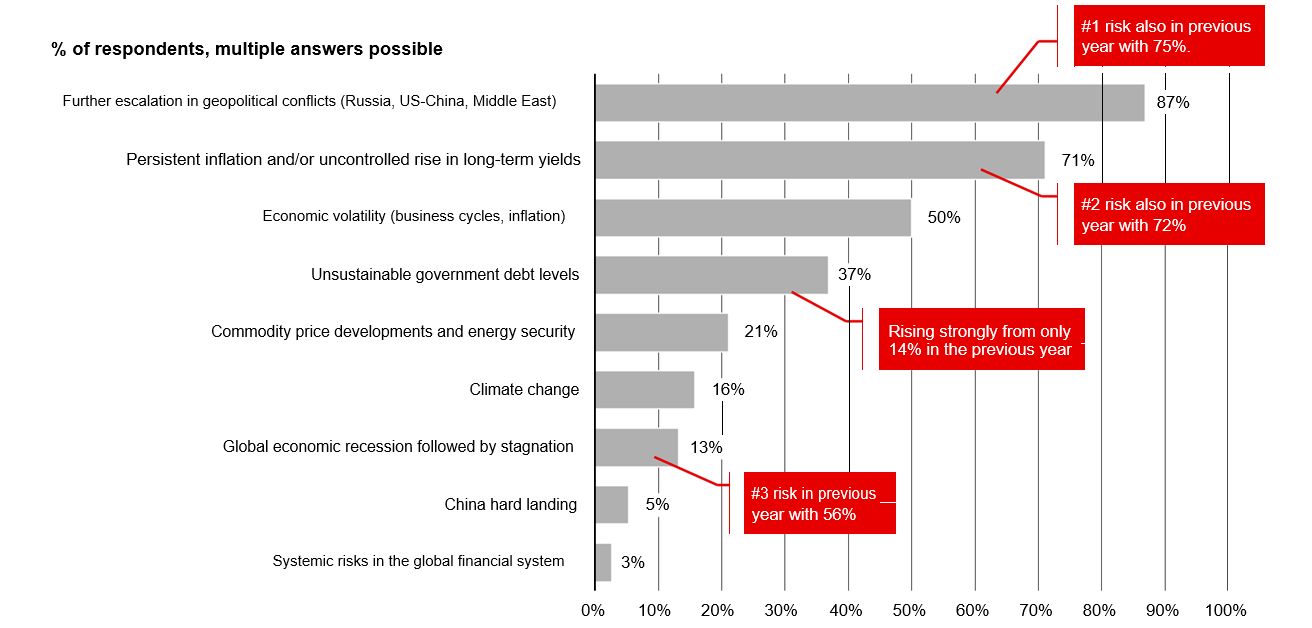

An overwhelming 87% of respondents in the 30th Annual Reserve Management Seminar (RMS) Survey conducted by Swiss banking giant UBS believe that a worsening of geopolitical rifts, particularly the Russia-Ukraine war, tensions between the US and China, and the Middle East conflict, is the top risk that will impact the global economy. That’s up from 75% of respondents last year and 80% in 2022.

Top economic concerns

What are the main risks that the global economy is currently facing?

Source: UBS Annual Reserve Manager Survey 2024

Source: UBS Annual Reserve Manager Survey 2024

The majority of respondents also believe that a Trump victory will lead to more geopolitical confrontations, along with a worsening of US-China relations, a weakening of the North Atlantic Treaty Organization (NATO), and an increase in global protectionism. On the economic front, they believe that a Trump presidency is likely to lead to lower interest rates, higher public deficit levels, and higher equity prices.

Not so lovelier

What would be the global implications of a Trump election victory when compared with a Biden/Democrat victory?

What would be the economic impact of a Trump election victory when compared with a Biden/Democrat victory?

Source: UBS Annual Reserve Manager Survey 2024

The results of the RMS Survey were based on responses from 40 central banks managing about half of global FX reserves, or more than US$15 trillion. The report was co-authored by Massimiliano Castelli and Philipp Salman, head and director, respectively, of strategy and advice, global sovereign markets, at UBS Asset Management.

Nearly all the respondents believe that the world is fragmenting and that we are moving to a multipolar system. Half of the respondents believe that the Russia-Ukraine conflict will only end after 2026, but the overwhelming majority believe that there will be no direct confrontation between NATO and Russia over the next five years. The weaponization of FX reserves is a growing concern.

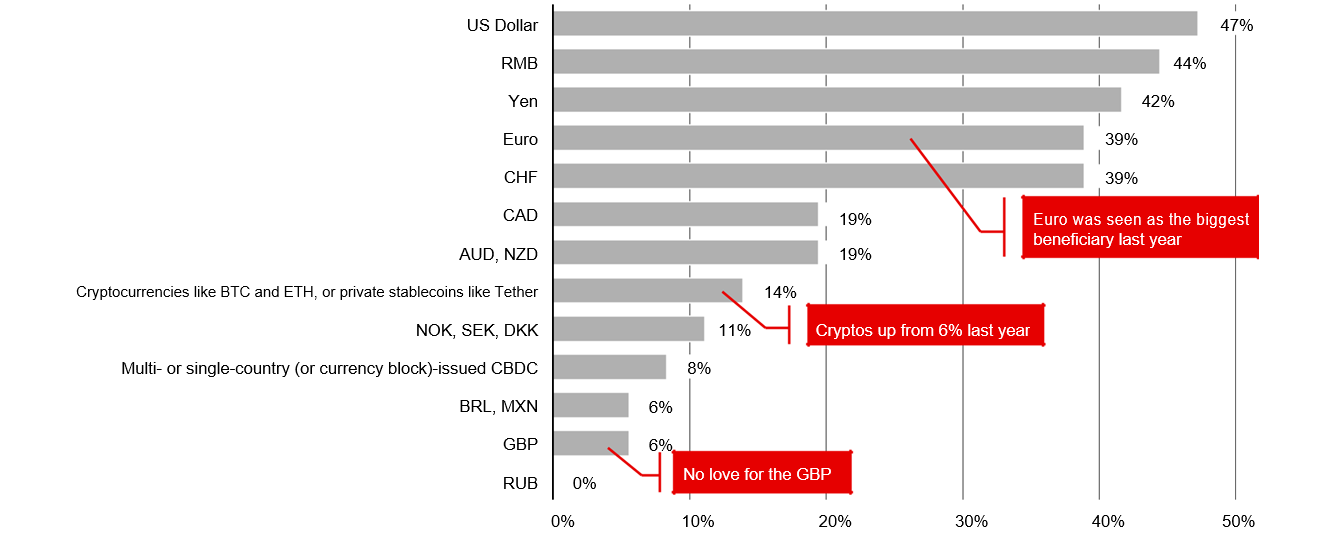

Reserve managers see no weakening in the dominant position of the US dollar in FX reserves. Nearly half of respondents believe that the shift to a multipolar system will not affect the greenback’s supremacy in the global financial architecture. On the other hand, allocations to RMB stagnated in 2023/24 and the average allocation to the Chinese currency fell to around 5%. In terms of future currency allocations, the euro appears to be more in demand, followed by the USD, the RMB and the yen.

Currencies outlook

Which reserve currencies or assets are most likely to benefit from macroeconomic and geopolitical shifts over the next 5 years?

Source: UBS Annual Reserve Manager Survey 2024

Source: UBS Annual Reserve Manager Survey 2024

This year’s survey coincides with the 80th anniversary of Bretton Woods, which created the International Monetary Fund and the World Bank. According to the majority of respondents (61%), these institutions are at risk of becoming obsolete when it comes to dealing with current global challenges (e.g., income equality, debt, growth, climate change, etc.) without reforms. On a similar note, 67% believe that the current international financial architecture is not resilient enough to survive current challenges without reforms.

The reforms, they assert, should focus on the future of multilateral cooperation in a fragmented world. A large majority believe that disruptive technologies such as digital assets and the rise of new economic powers provide more opportunities than challenges.

Other major risks to the global economy cited by the respondents include persistent inflation and/or an uncontrolled rise in long-term yields (71%), economic volatility (50%), and unsustainable government debt levels (37%, up from 14% in 2023). The risk of a global economic recession, which ranked third in the previous year (56%), dropped to only 13%.

When it comes to risks specifically related to the investment of FX reserves, the top concern cited by 78% of respondents is rising US interest rates and inflation, up from 63% in 2023. Another risk that is on an upward trend is (geo)political weaponization of FX reserves, which increased to 32% from only 10% in the previous year.

Central banks are positive about the global economic outlook. Two-thirds (66%) of the respondents see a soft landing as the most likely scenario (only 11% believe that the US will suffer a recession). About 71% of survey participants expect the US headline CPI to end up in a 2-3% range in one year at the next annual RMS meeting in June 2025, and no participant expects the CPI to go higher than 4% or below 1%. When it comes to Fed policy rates in one year, 53% expect them to be between 3% and 4%.