The Network of Central Banks and Supervisors for Greening the Financial System (NGFS), an international network of 127 central banks and financial supervisors seeking to scale up green finance, has published the latest edition of its climate scenarios framework, reflecting changes in carbon emissions, climate policy changes and macroeconomic conditions.

The NGFS climate scenarios provide a common and useful reference for central banks, supervisors, and other public and private organizations to assess the macro financial risks posed by climate change, and find the opportunities in the way towards a decarbonized future.

Many top-tier financial institutions, such as BNP Paribas, UBS and Citibank, incorporate parameters in the NGFS climate scenarios to conduct climate stress-testing on their balance sheets.

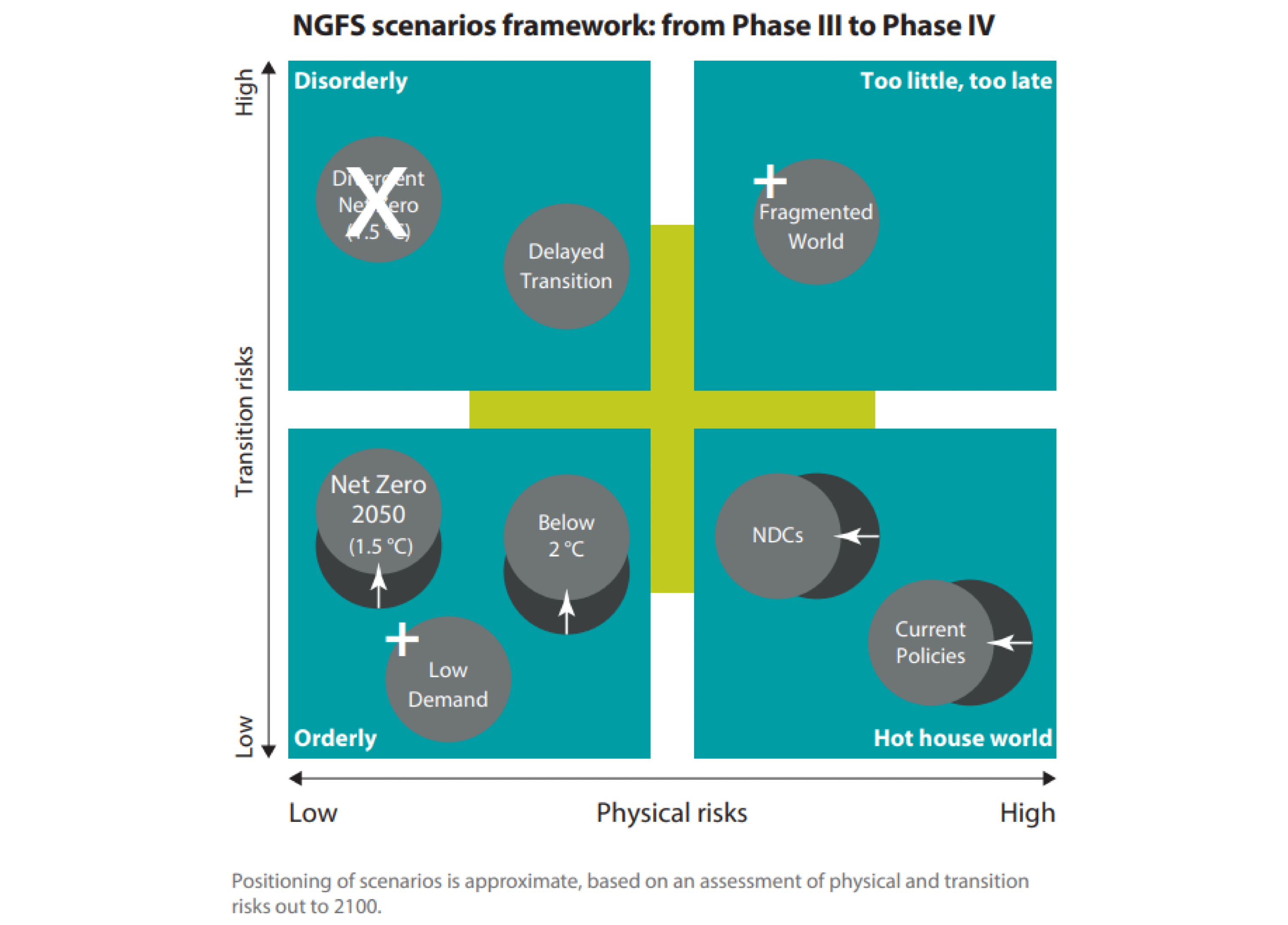

The NGFS developed a four-quadrant diagram labelled with different levels of physical risks and transition risks to illustrate different scenarios the world faces during the climate transition.

Conceptually, the “orderly” quadrant is with low levels of both physical risks and transition risks, and is aligned with the Paris agreement. The “disorderly” quadrant is with low level of physical risks and high level of transition risks.

The “hot house world” quadrant is with high level of physical risks and low level of transition risks, and is where the current policies and prevailing NDC (nationally determined contribution) goals might lead us. Finally, the “too little, too late” quadrant is with high levels of both physical and transition risks, the result of a late and uncoordinated transition.

Source: NGFS

Source: NGFS

New scenarios

The latest edition of the climate scenarios framework (phase IV) incorporates data reflecting the impact of new country-level policies, changing GDP and population numbers, current geopolitical contexts, and the latest technological advancements.

Compared with phase III (published in September 2022), the phase IV scenarios framework introduces two new scenarios: the “low demand” scenario in the orderly quadrant, and the “fragmented world” in the “too little, too late” quadrant. The “divergent net-zero” scenario is removed. Thus, the NGFS climate scenarios now comprise seven scenarios in total.

The new “fragmented world” scenario assumes a delayed and divergent climate policy response among countries globally. In this scenario, NGFS foresees that countries with net-zero targets only partially achieve them at 80%, while the other countries follow current policies. Following this scenario, over 5% of global GDP loss will be incurred by 2050, and the end-of-century warming will be 2.3°C.

In another new scenario, the “lower demand” scenario, the 1.5°C target by 2100 is still within the reach, but lower energy demand and stronger behavioural changes are required for this to happen in an orderly way.

The other two scenarios in the “orderly” quadrant now face higher-level transition risks, with a tendency to become disorderly due to continuously increasing baseline emissions, delayed climate policy, and the ongoing war in Ukraine.

Finally, the two scenarios in the “hot house world” quadrant are revised with lower level of physical risks given newly announced commitments or newly implemented policies. Nevertheless, these scenarios still indicate GDP losses from acute and chronic climate events of up to approximately 14% by 2050, and a burning world that is 2.4°C (the NDCs scenario) to 2.9°C (the current policies scenario) hotter by end-of-century.

Acute physical risks

“The latest iteration of the NGFS scenarios thus incorporates acute physical risks. It also provides further insights on how physical risks and transition policies affect the macroeconomy,” explains Ravi Menon, chair of the NGFS and managing director of the Monetary Authority of Singapore. “We hope that the updated NGFS scenarios and accompanying documents will enable central banks, supervisors and the broader financial community to better analyze climate-related financial risks.”

Overall, the updated framework presents a more complex and challenging future for combating climate change, which calls for stronger collaborative efforts of the international community. The 28th United Nations Cliamte Change Conference (COP28), scheduled to open in Dubai on November 30, provides a critical venue for governments to renew their commitments to climate action.

According to NGFS, the phase IV scenarios will be updated in 2024 to further subdivide industry classifications and enhance the calculation of physical risks.