The growing interest in environmental, social and governance (ESG) factors reflects a developing trend that asset owners and investors are increasingly focused on sustainability alongside investment performance. BNP Paribas Asset Management (BNP Paribas AM) believes ESG factors are integral in emerging market (EM) investing.

In an interview with The Asset, L. Bryan Carter, Head of Emerging Market Fixed Income and Helena Vines-Fiestas, Head of Sustainability Research & Policy at BNP Paribas AM discussed their unique ESG approach to EM investing and its impact on long-term investment performance.

How do you integrate an ESG framework into EM debt investing?

We are an early adopter of ESG investment approaches across our portfolios. With a deeply skilled ESG research team, we have access to hundreds of data sources spanning all categories of ESG ratings, and have the capabilities to tailor and craft a unique approach suited to the nuances and dynamic realities of EM countries.

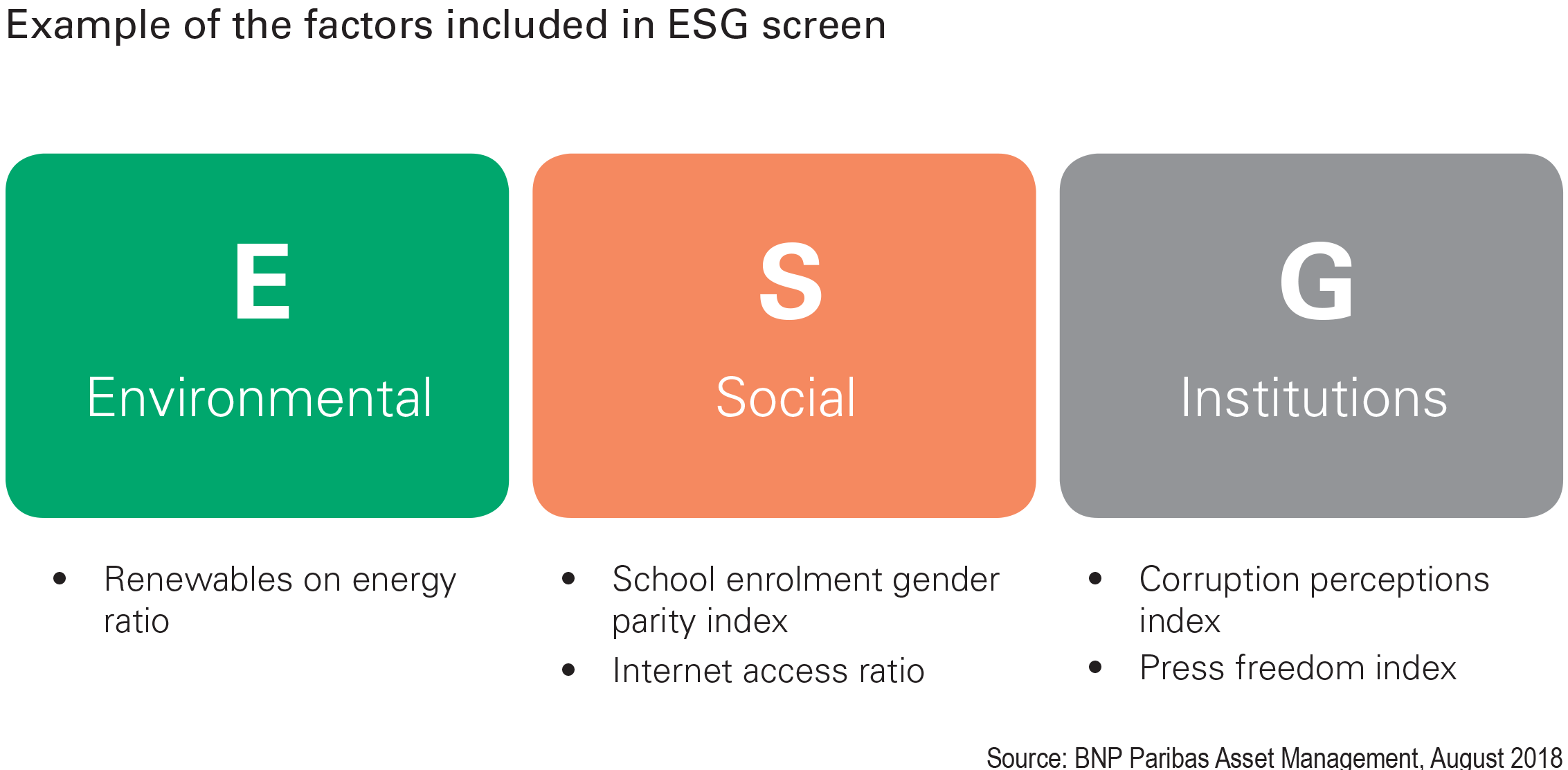

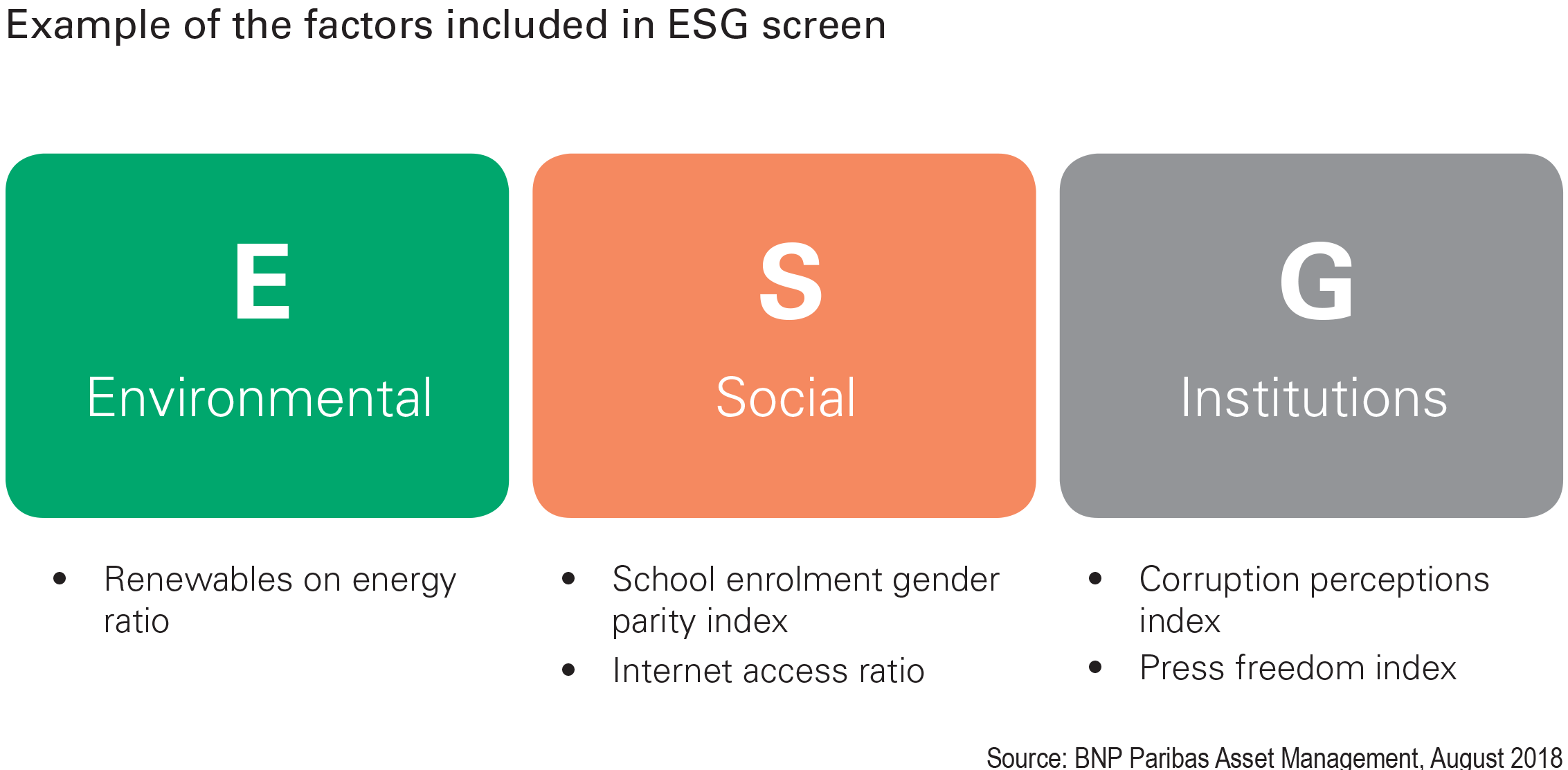

Our sovereign debt ESG model assesses governments' ability to protect citizens' best interests and provide services and goods embedding environmental, social, or institutional strength. However, coverage is a special challenge given that for the 90 EM countries that we invest in, a full spectrum of data is not always available and certainly not on a regular basis. Navigating this constraint, our EM debt ESG screen incorporates ESG criteria alongside economic factors with consistent cross-sectional coverage such as below:

What’s unique about this ESG integration?

The novelty of our approach is that instead of inclusion or exclusion lists, we use our composite score on each of the 90 EM countries to determine position sizing for investments in our portfolios. We blend the country's alpha opportunity with its ESG rating in the portfolio construction process, in essence increasing our overweights in high ESG countries and curbing our overweights in low ESG countries.

We do still invest in low ESG countries where the alpha conviction is high, but we invest less in such countries than would otherwise be the case. In aggregate, this bottom-up ESG sizing approach produces an overall ESG tilted portfolio without limiting diversification or truncating the alpha set.

The uniqueness of EM as an asset class derives from the very idea that some constituents begin from a very low base and may offer outsized investment gains as they develop. In tandem with development, side effects can arise that we label ESG-unfriendly or unsustainable: pollution, social tensions and institutional crises. Our approach allows for this character of EM investing, while limiting the potential for unsustainable policies to become 'blow ups'.

How is this ESG integration working for your investment?

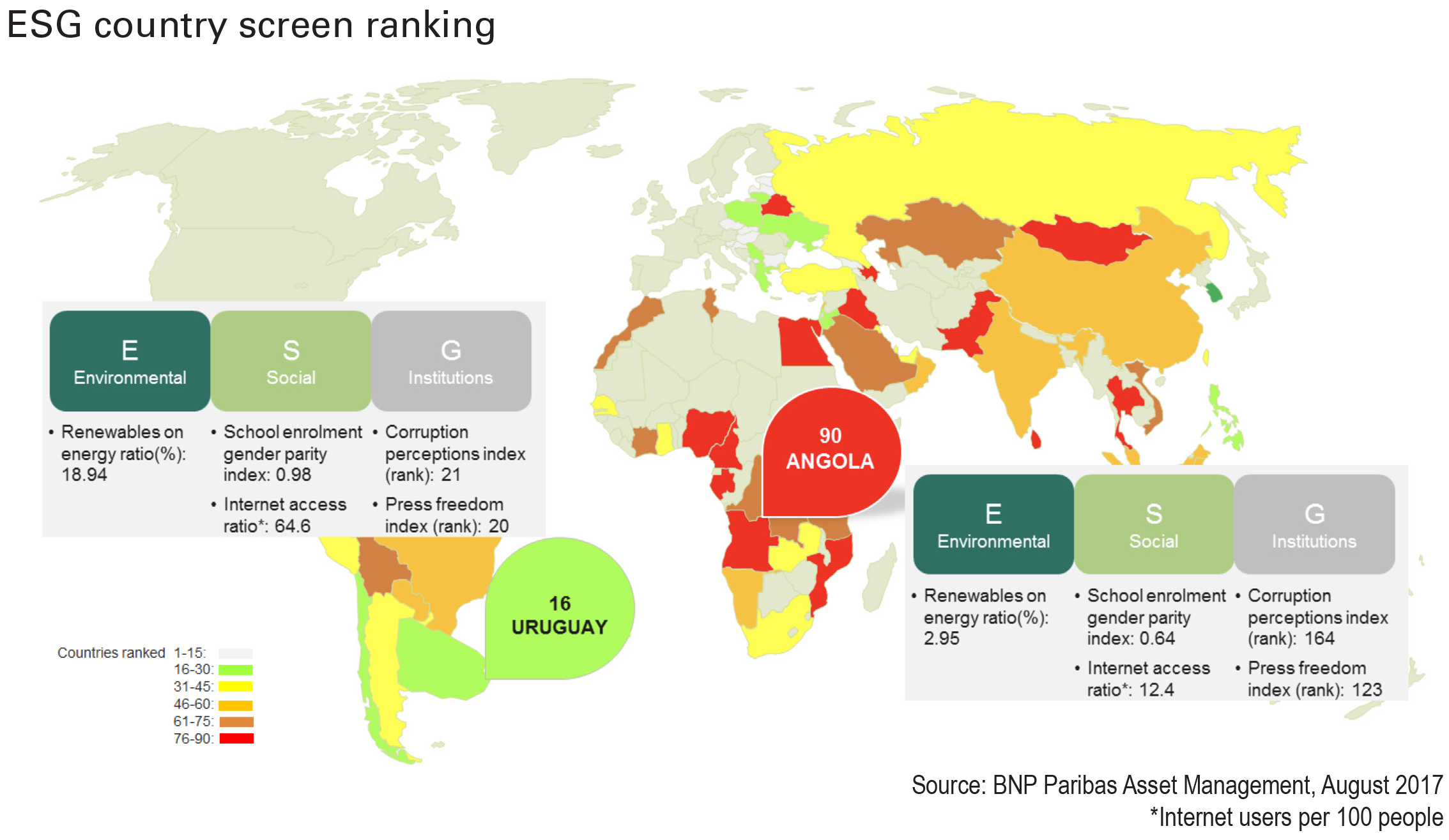

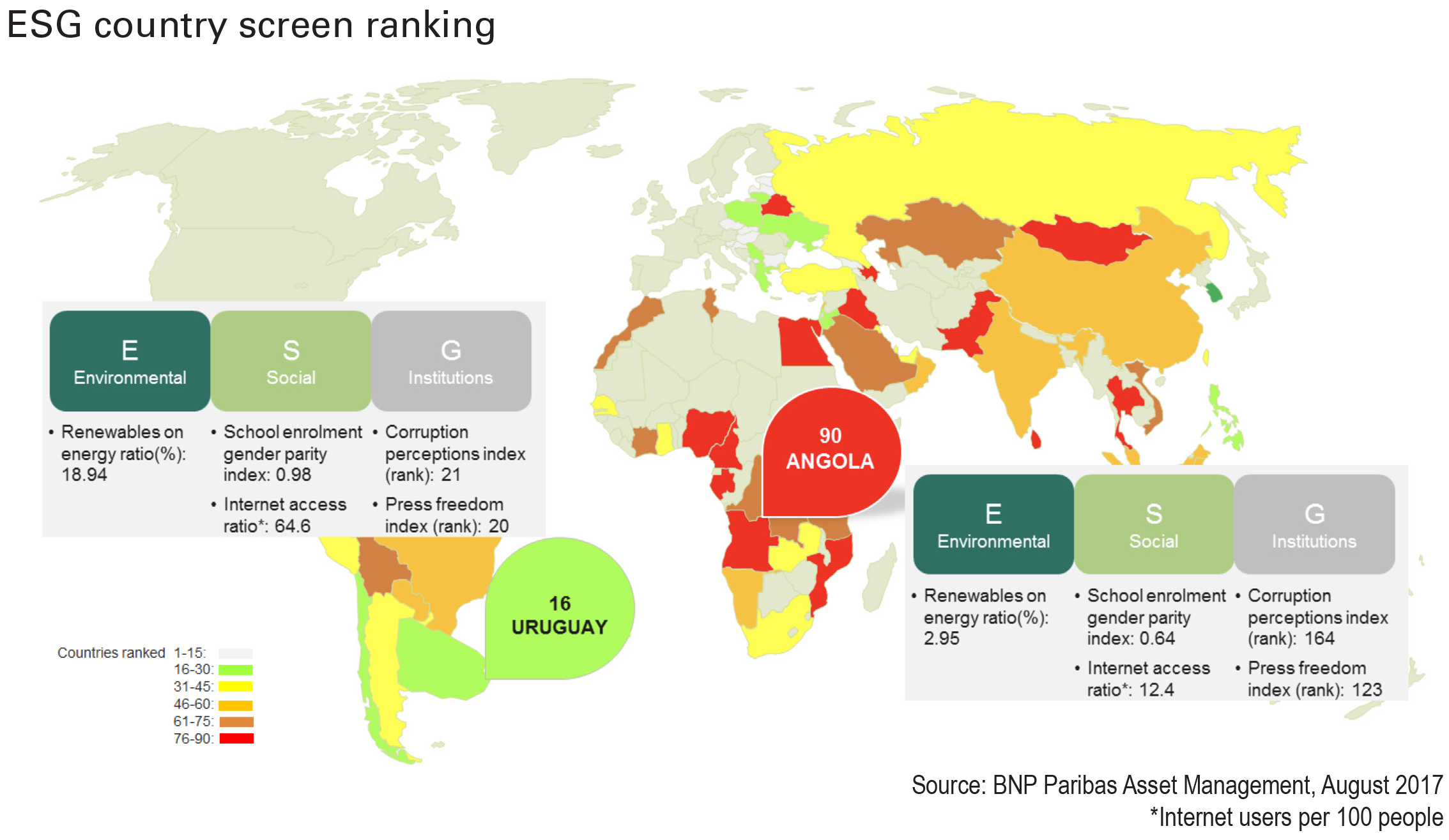

Attribution analysis has shown that ESG tilting at the portfolio construction stage of our investment process does generate additional performance for portfolios. To evidence the ESG screen in practice, we have highlighted the differences between Uruguay and Angola, two countries that the screen has shown to have very different ESG attributes. Uruguay is currently overweight in our flagship blended portfolio, the size of the position having been increased thanks to its positive ranking in the ESG screen. Conversely, Angola, which is the lowest ranking country in the screen, has been consistently underweight in the portfolio.

Another key rationale for taking ESG rankings into consideration when trades are sized is to help us avoid 'blow ups' when a country may renege on its debt obligations. Three examples of this are Mozambique, Venezuela and Republic of Congo. All three countries score in the bottom tercile of our ESG methodology. These countries have had very low governance scores historically and recently poor governance has become manifest increasingly via sharp deterioration in macroeconomic conditions and fiscal management leading to debt distress; the impact of which has not affected our portfolios since we have been underweight these markets as indicated by the low rating in our ESG screen.

What’s driving investors to adopt ESG?

There are various reasons that investors favour ESG approaches, including the exposure to reputational risk. Some investors but not all believe in the data demonstrating the long-term outperformance and potential dividends of ESG factors. A growing number of investors are driven by mandates or by the fact that asset owners demand that ESG factors are taken into account. Many investors simply want to do well by doing good. Their investments are providing the much needed finance for longterm sustainable growth where it is most needed. We believe each of these reasons are valid for ESG investing.

BNP Paribas AM embraces an ethos of responsibility, that to be a global leader, we must look to the future and take a stand on the implications of our enterprise and the long-term viability of our holdings. Applied to EM, we see our ESG process as ahead of the curve and we hope to help trigger greater awareness of ESG among all investors with a nuanced and considered approach specific to a unique and exciting asset class.

This article is third in a series on Sustainable Investing by BNP Paribas Asset Management. The last instalment will discuss the outlook for sustainable investing in 2019.

Disclaimer: This material has been prepared and issued by BNP PARIBAS ASSET MANAGEMENT Singapore Limited (BNPP AMS)* and BNP PARIBAS ASSET MANAGEMENT Asia Limited (BNPP AMA)**. It is intended for Institutional Investors (as defined in the Securities and Futures Act, Chapter 289 of Singapore) only and is not suitable or intended for persons who do not qualify as such. The content has not been reviewed by the Monetary Authority of Singapore (“MAS”) or the Hong Kong Securities and Futures Commission (“HKSFC”). It is produced for information purposes and does not constitute any offer or investment advice. Investors should seek independent professional advice before investing, or in the absence thereof, he/she should consider whether the investments are suitable for him/her. Opinions included in this material constitute the judgement of BNPP AMS and BNPP AMA at the time specified and may be subject to change without notice. BNPP AMS and BNPP AMA are not obliged to update or alter the information or opinions contained within this material. Investments involve risks. The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial investment. Investors should refer to the offering document for further details including risk factors. *BNP PARIBAS ASSET MANAGEMENT Singapore Limited - Registered Office: 20 Collyer Quay, #01-01, Singapore 049319. Company Registration No:199308471D. **BNP PARIBAS ASSET MANAGEMENT Asia Limited: 17/F, Lincoln House, Taikoo Place, Quarry Bay, Hong Kong.