Welcome back! This is the second article in our three-part series on “ESG take-up in the spotlight”, based on findings from an in-depth survey with CEOs, CFOs, CSOs, Treasury professionals and experts from BNP Paribas sharing their voices and insights on the latest trends in ESG strategy and market developments in sustainable finance.

The previous section included an overview of key questions related to ESG strategy and sustainable finance that senior executives and board members care about. The survey responses indicated that this area is showing significant development with a promising outlook.

The next step after ESG strategy board integration is to enable ESG to permeate beyond the boardroom and across the organisation. This stage is perceived to be more challenging according to the survey.

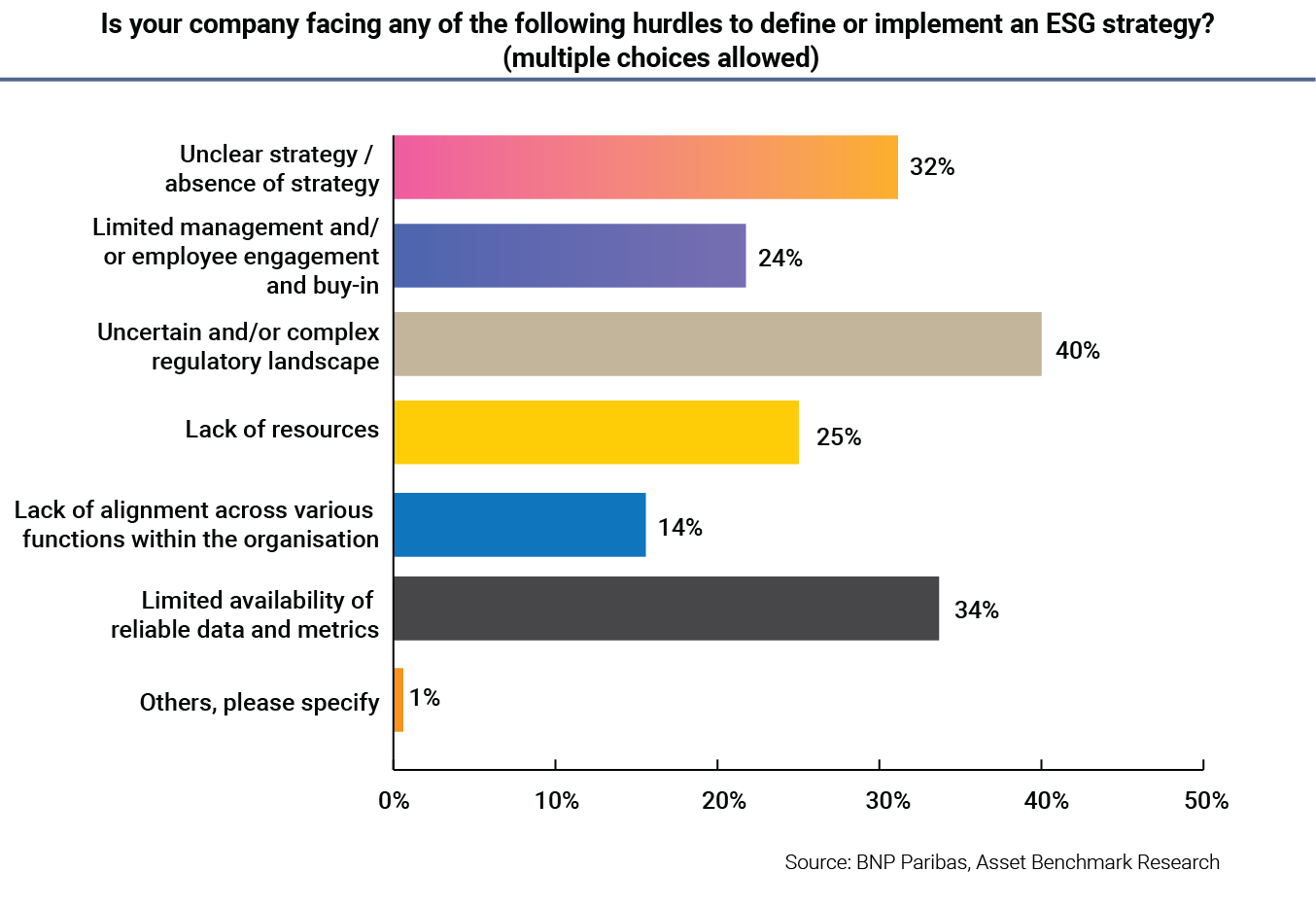

Section 2 of the report identifies four factors that may impede ESG strategy from being effectively implemented:

• Complexity of regulations

• Lack of clear strategy

• Limited availability of reliable data and metrics

• Lack of financial resources

Complexity of regulations

The first challenge, complexity of ESG regulations, is a global phenomenon. The number of ESG regulations across the world has grown substantially in recent years, according to data from the United Nations' Principles for Responsible Investment (UN PRI). In Europe, we have seen increasing regulations around sustainability reporting, sustainable finance products and carbon markets. In Asia, we are also seeing an increased number of policies around mandatory ESG and climate information disclosure, and taxonomies around transition finance and green finance solutions.

Table 1: Selected sustainability regulations and guidelines in Europe and Asia launched in recent years

| Europe | Asia |

|---|---|

| CBAM: Carbon Border Adjustment Mechanism Effective: October 2023 (transition period until end of 2025) |

Singapore-Asia Taxonomy for Sustainable Finance (launched in December 2023) |

| CSRD: Corporate Sustainability Reporting Directive Effective: January 2023 |

Singapore Exchange’s mandatory climate-related disclosures (phased in since 2022) |

| SFDR: Sustainable Finance Disclosures Regulation Effective: March 2021 |

Hong Kong Securities and Futures Commission’s Agenda for Green and Sustainable Finance (updated in August 2022) Hong Kong Taxonomy for Sustainable Finance (launched in May 2024) |

| China-EU Common Ground Taxonomy (launched in 2021, updated in June 2022) |

|

Eric Tran, Head of Sustainability, Transaction Banking APAC, at BNP Paribas, points out: “With the introduction of new EU regulations, multinational corporations, particularly companies operating in the EU, face significant compliance challenges impacting their value chain partners globally and particularly in Asia.”

In the face of this fast-evolving regulatory landscape, companies, to stay compliant, need to input significant resources, including time, effort and financial resources.

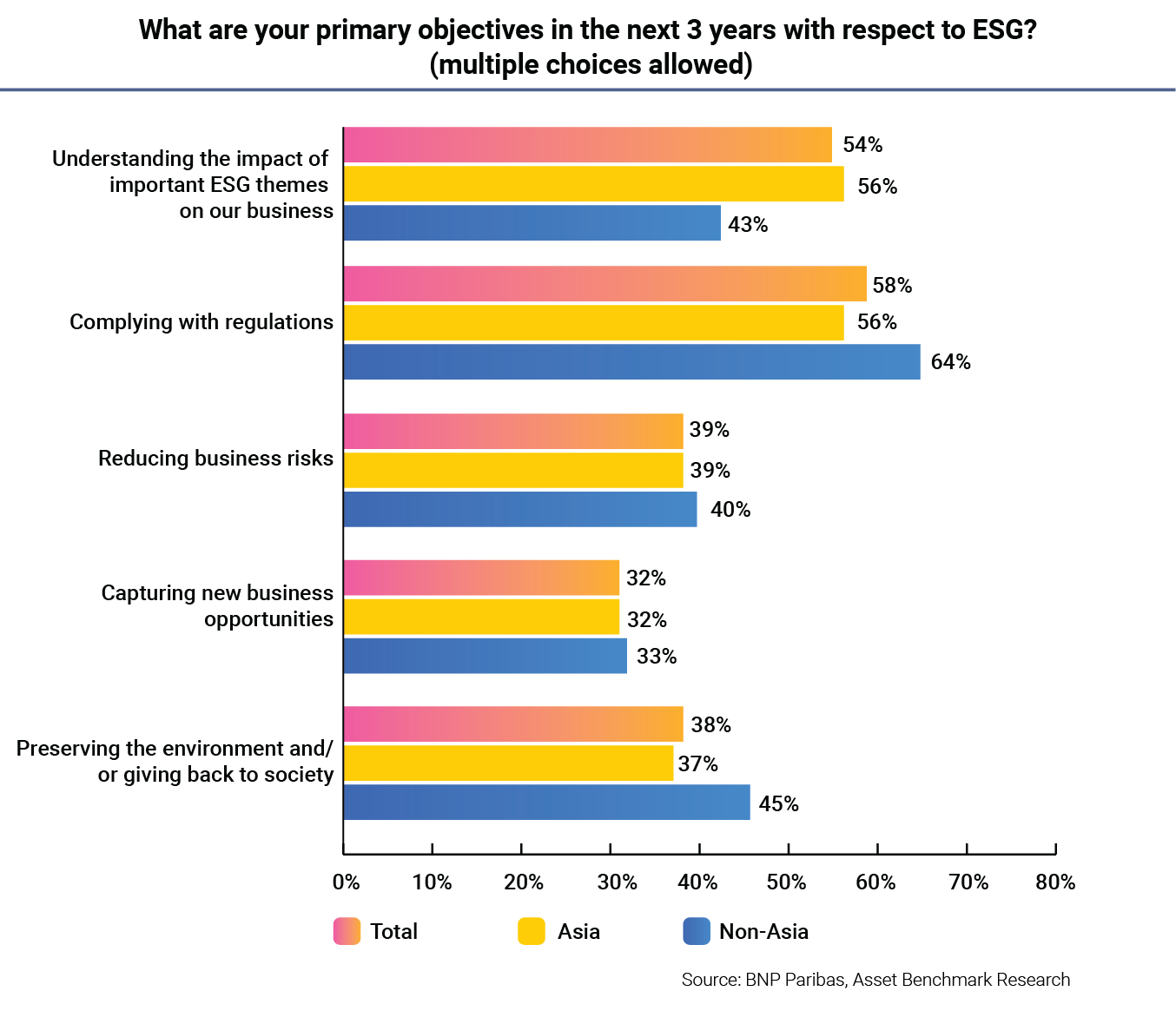

This also explains why many corporates indicate compliance is their top consideration when addressing ESG issues. According to the survey, 58% of respondents say their primary objective with respect to ESG in the next three years is to “comply with regulations”, ahead of other considerations, such as “capturing business opportunities” or “giving back to society”.

In general, companies outside of Asia attach more importance to compliance than those in Asia do, as 64% of respondents from non-Asian companies cite the intent to “comply with regulations” as their key ESG objective in the short term, compared with 56% from Asian companies.

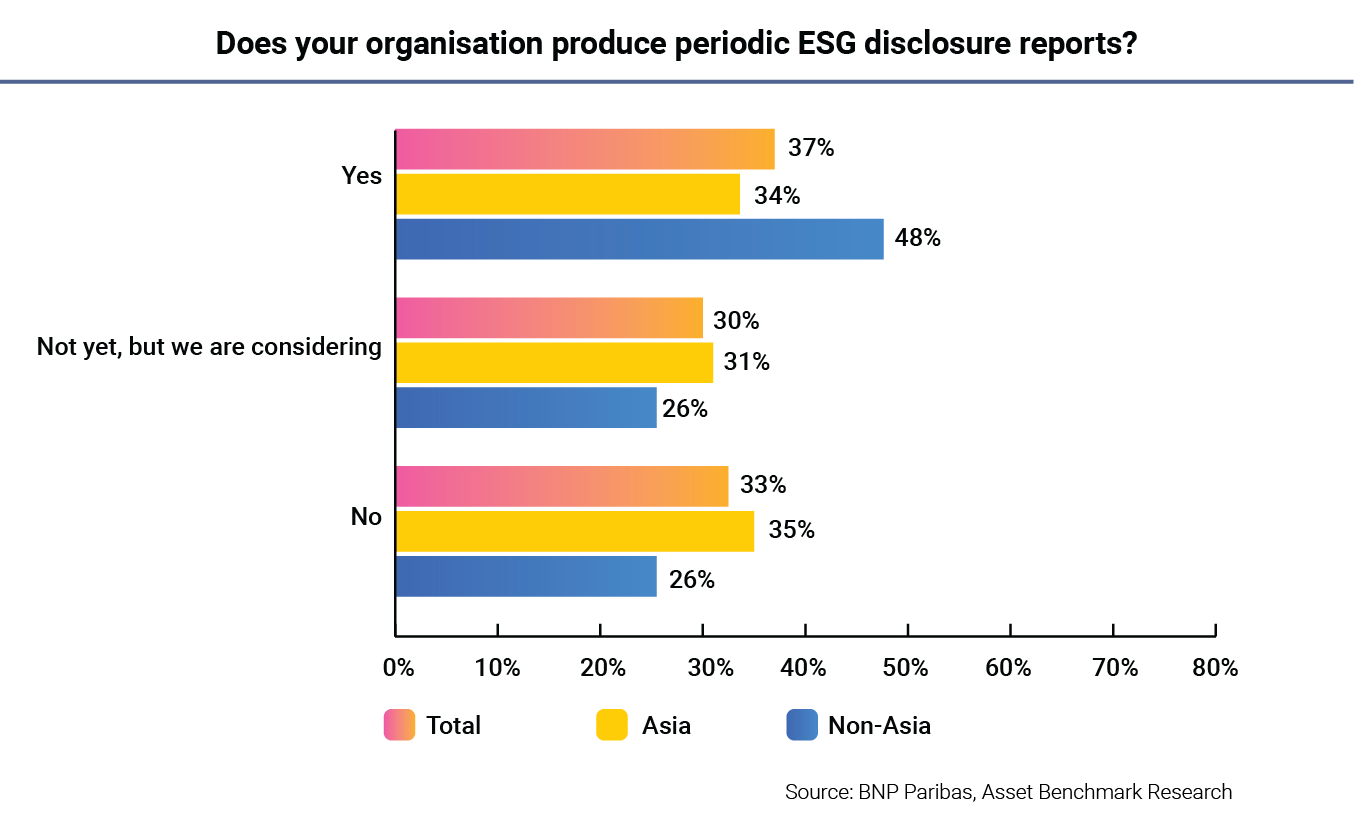

Non-Asian companies are also more likely to be more transparent with regard to ESG disclosures, according to the survey. For example, 48% of respondents from non-Asian companies say they perform regular ESG disclosures. By comparison, only 34% of Asian companies do so.

Lack of a clear strategy

Apart from the complexity brought by regulations, the lack of a clear strategy is the second most common impediment to ESG integration within organisations. Taking the setting up of clear ESG targets as an example, one-third of the respondents say their companies either don’t have ESG targets or they do not know if their companies have them. This lack of awareness in corporate ESG targets suggests that the communication of ESG strategy within the organisation is not clear or smooth enough.

Q: How can CFOs and treasurers bridge the gap on sustainability?

A: Given the uncertain and complex regulatory environment, and sometimes a lack of clarity/alignment in ESG strategy within organisations, CFOs and treasurers are faced with conflicting priorities. They are driven by balance sheet and capital optimisation needs. However, they also play a unique and important role to drive ESG strategy, partnering with banks on multiple fronts while managing costs and ESG risks.

Their expanded role includes gathering ESG intelligence on investors’ views, industry peers and key trends and deploying sustainable financing framework and instruments (including trade) to align ESG investments and KPIs throughout their organisation.

Leveraging banks like BNP Paribas may help to accelerate ESG integration within organisations, which is a proven key differentiator in terms of creating long-term business value. The use of sustainable finance is now part of the C-level toolkit to accelerate the integration and the alignment of the ESG strategy within the organisation, not only across functions (e.g., procurement, treasury, ESG, etc.), but also across regions and value chains.

In addition, the survey finds that environmental targets are given the highest priority, ahead of social and governance, with net-zero environmental targets standing out as one of the most popular. According to the survey, 34% of respondents are determined to attain net zero by 2050, with the most ambitious companies aiming to achieve it by 2030. Amongst the remaining 66% of the respondents who don’t have a net-zero target, about half of them indicate that they are trying to address this.

.png)

Limited availability of reliable data and metrics

There are gaps, however, between having a net-zero goal and the practice of working towards it. One of the most significant gaps identified in the research is that of a company’s ability to measure greenhouse gas (GHG) emissions. Specifically, we find that 70% of the surveyed companies aren’t tracking their GHG emission data. Of those who can perform GHG accounting, less than 10% track their GHG accounting in full, which includes accounting for Scope 3 emissions along their value chains. Non-Asian companies stand out in this respect as their proportion of tracking Scope 3 emissions is four times higher than their Asian peers.

.png)

The main reason for incomplete GHG emission accounting, as shared by the respondents, is the limited availability of reliable data and metrics. Hence, the lack of high-quality data is the third significant challenge for companies working to implement an ESG strategy.

from an Asia-based private company

“We often hear challenges from clients around their Scope 3 and supply chain emissions reduction,” says Cynthia Tchikoltsoff, Head of Global Trade Solutions, APAC, at BNP Paribas. “As a result, we offer a combination of solutions to help to drive more sustainable and resilient supply chain which include creating transparency through primary data collection, granting capital to the suppliers through supply chain finance so they have the means to invest in climate initiative, and plugging financial incentives and setting up targets to encourage the adoption of good practices.”

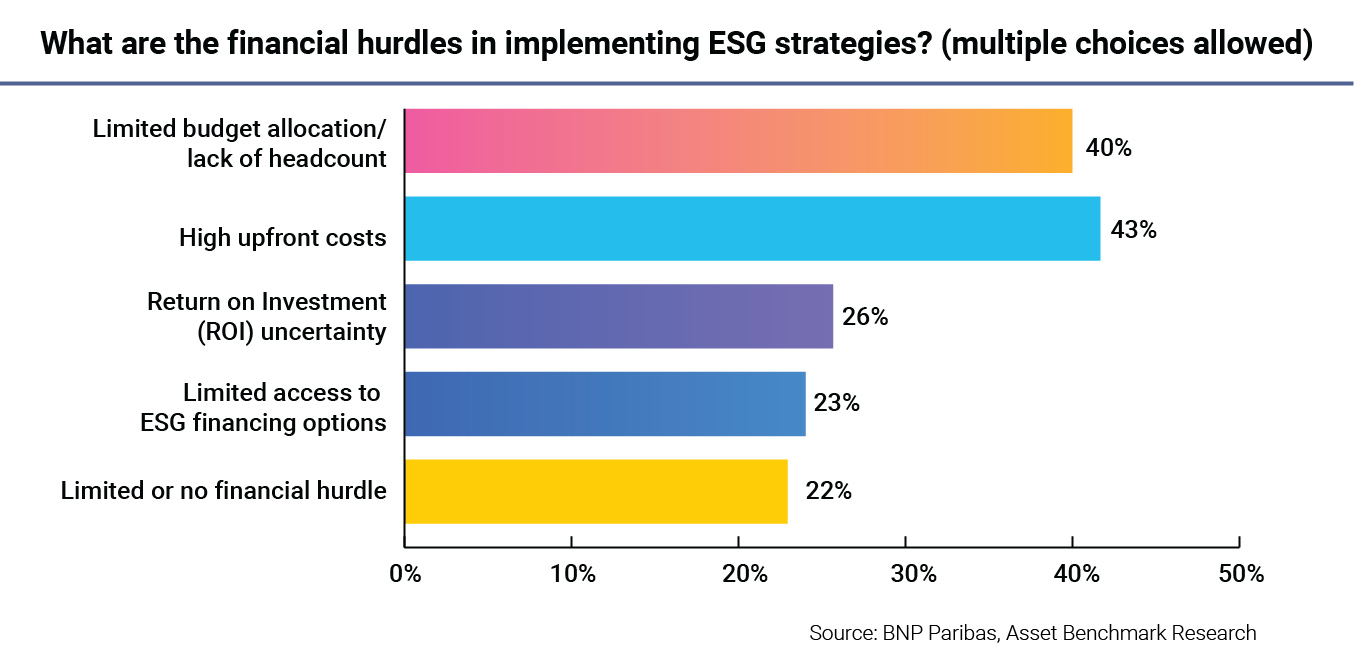

Lack of financial resources

Finally, the fourth challenge faced by companies is the lack of financial resources. Notably, 40% of survey respondents attribute their slow adoption of ESG to limited budget allocation, while 43% see high upfront costs as the main hurdle to adoption. The presence of this challenge also echoes our previous finding that CFOs and treasurers’ influence and involvement in ESG strategy are still insufficient. Hence, the resources are under-allocated.

Despite these challenges, companies are actively searching for solutions. The research found two ways companies choose to enhance their capabilities in ESG strategy and sustainable finance.

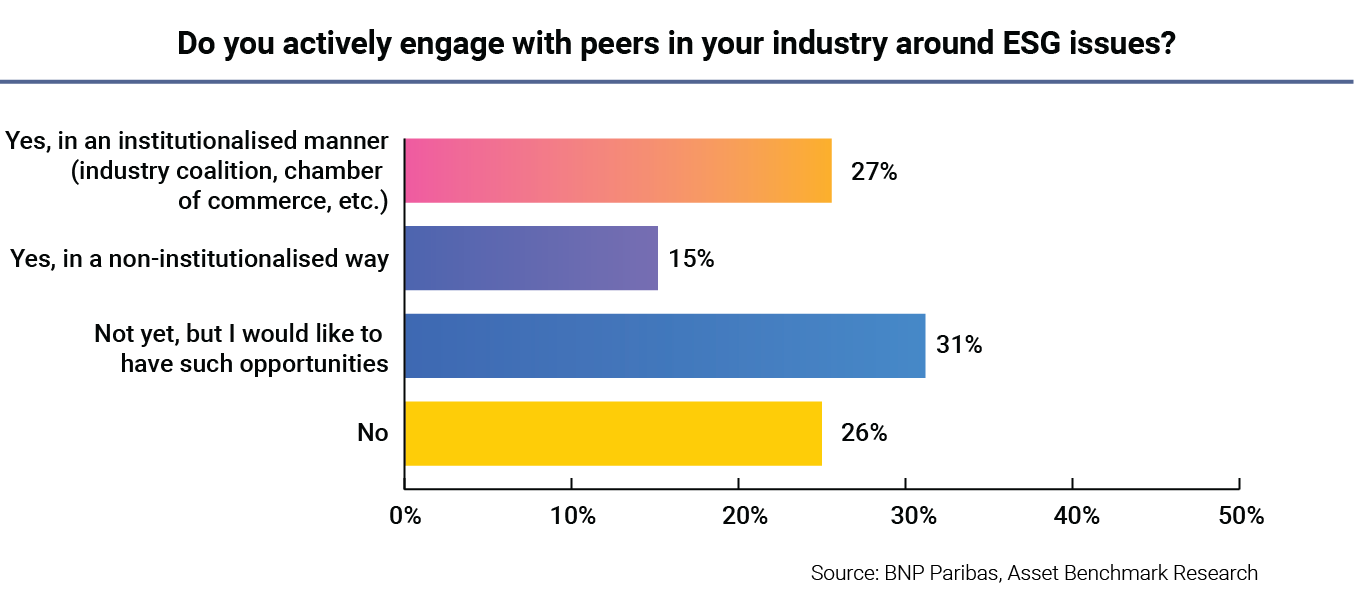

First, companies will often seek to engage with industry peers in understanding ESG issues and learn from each other. As shown in the survey, 42% of the participating companies are engaging with their industry peers, and 31% are looking forward to having such engagement opportunities. Formal events organised by industry coalitions and chambers of commerce or informal dialogues conducted privately are all helpful for a company’s ESG learning.

In the meantime, CEOs and CFOs are also increasingly partnering with their banks on multiple fronts to drive their ESG strategy further. Companies are looking forward to more ESG advisory services and more sustainable finance solutions from banks. This emerging alliance between companies and banks on ESG strategy and sustainable finance is bringing opportunities for both parties to reshape their practices around ESG-embedded working capital and supply-chain management.

“ESG integration is a slow-moving and effort-intensive journey that often spans across the entire organisation and value chain,” Tran says. “Banks like BNP Paribas offer advisory services to help corporates establish targets or sustainability frameworks that would be reviewed by an external party. This is particularly relevant where corporates may need expertise to validate some sustainability claims in situations where there are concerns and even legal liability over greenwashing. This target or framework can be then be linked to financing instruments, an LC[Letter of Credit] or guarantee that can help to save costs and to demonstrate sustainability leadership to customers or investors.”

In the next and final section of the report, we will explore the types of financing solutions that can help to move the needle for CFOs and treasurers embarking on an ESG journey.

This is part of a series of articles on “ESG take-up in the spotlight”, based on a survey commissioned by BNP Paribas.

BNP Paribas and Asset Benchmark Research gathered feedback from over 200 CEOs, CFOs, CSOs and other senior managers from corporations around the globe on their views on ESG adoption and what they expected from their service providers to take their respective companies to the next level of sustainability development. To ensure a comprehensive understanding of their viewpoints, respondents were involved in one-on-one interviews and an online survey was conducted in the first half of 2024.