Transparency in China’s policy on renminbi and the currency’s stability are factors that will encourage corporates to boost the use of the Chinese currency.

Willingness of China-base suppliers to accept the renminbi for their services and products could also encourage increased use of the currency,

“In China the supplier themselves may prefer for you to pay them in USD, in a way because these days they also want to keep more foreign reserves themselves,” explains a Hong Kong-based CFO who participated in the survey.

Clear Chinese monetary policy was also cited as being a catalyst for renminbi usage with participants concerned about the possibility that China will suddenly devalue its currency in an effort to support economic growth.

“China obviously has its five-year plan when it comes to the economy and also when it comes to new regulations,” highlights a Singapore-based treasurer. “That’s all good but then at some point they need to firm up and embed the new regulations and legal requirements around that.”

The renminbi has had quite an interesting 2016. From being included into the International Monetary Fund’s SDR (special drawing rights) basket to being widely being used for cross-border settlements/payments, Chinese currency is slowly, but surely moving to become a true international currency.

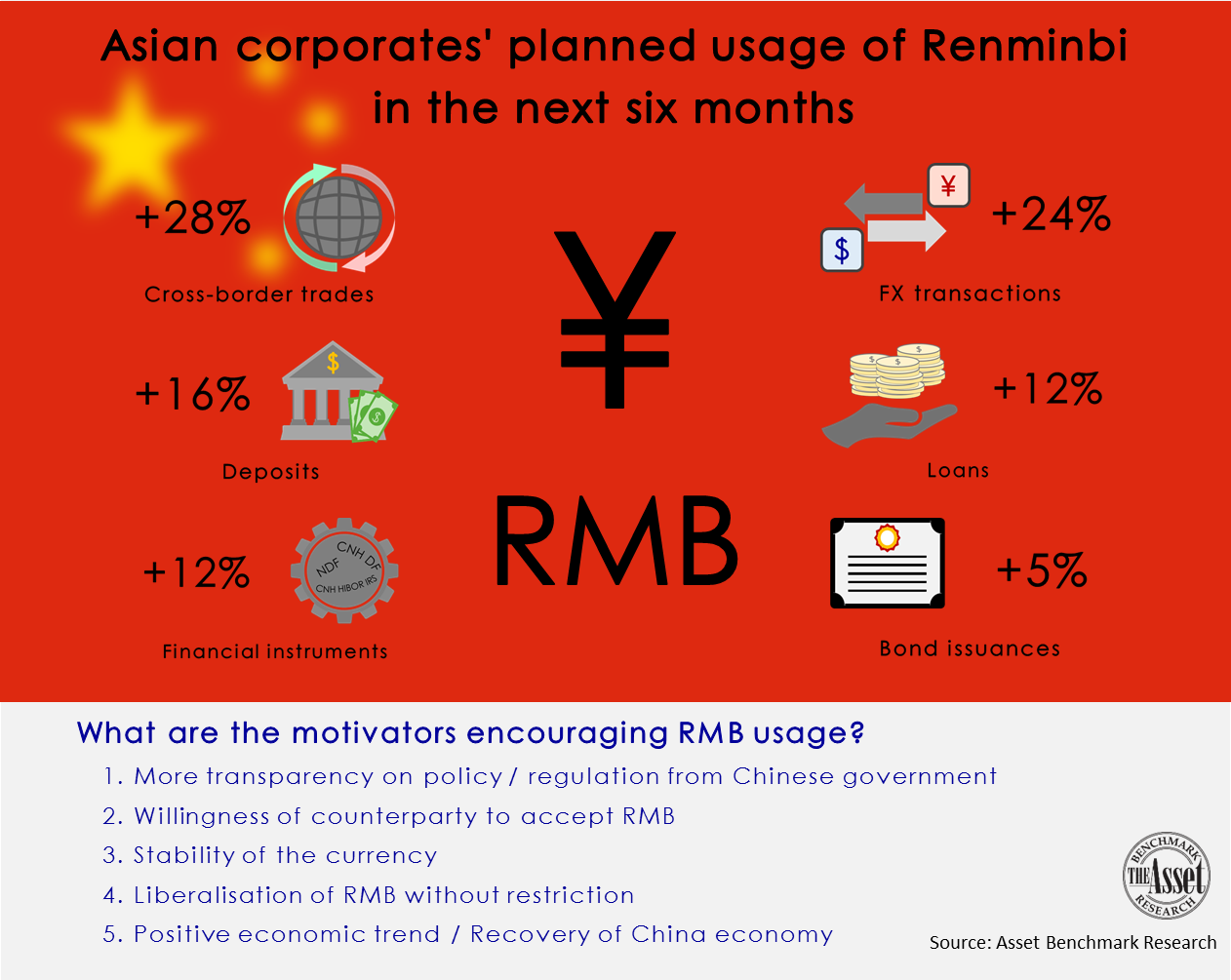

Despite the achievements, the Chinese government still needs to put in place additional measures to encourage the sustainable usage of the renminbi. According to a recent survey by Asset Benchmark Research of Asian-based CFO and treasurers, the increased usage of the renminbi will depend on several factors including the willingness of their counterparties settle in the currency.

Other participants in addition also pointed to the liberation of the capital account one area that would make the renminbi more appealing to them. However, currently China seems to be doing the placing further restrictions in an effort stabilize its currency and curb capital outflows from the country. Chinese FX reserves have fallen to US$3.05 trillion as of November 2016, earlier this year it was around US$3.30 trillion.

In terms of additional future usage of offshore renminbi products, around 28% of survey participants say they will increase their renminbi cross-border trade followed by renminbi FX transactions (24%) and deposits (16%).

To read more about Asset Benchmark Research, click here.

Additional reporting by Jacky Fung