Virtual bank WeLab Bank has finally launched in Hong Kong, offering its clients fully digital banking services round the clock from their mobile phones.

WeLab offers clients a range of services such as time deposits with competitive rates, an interest-bearing deposit account with an instant virtual debit card, and real-time payments powered by its Faster Payment System (FPS), the bank says in a statement.

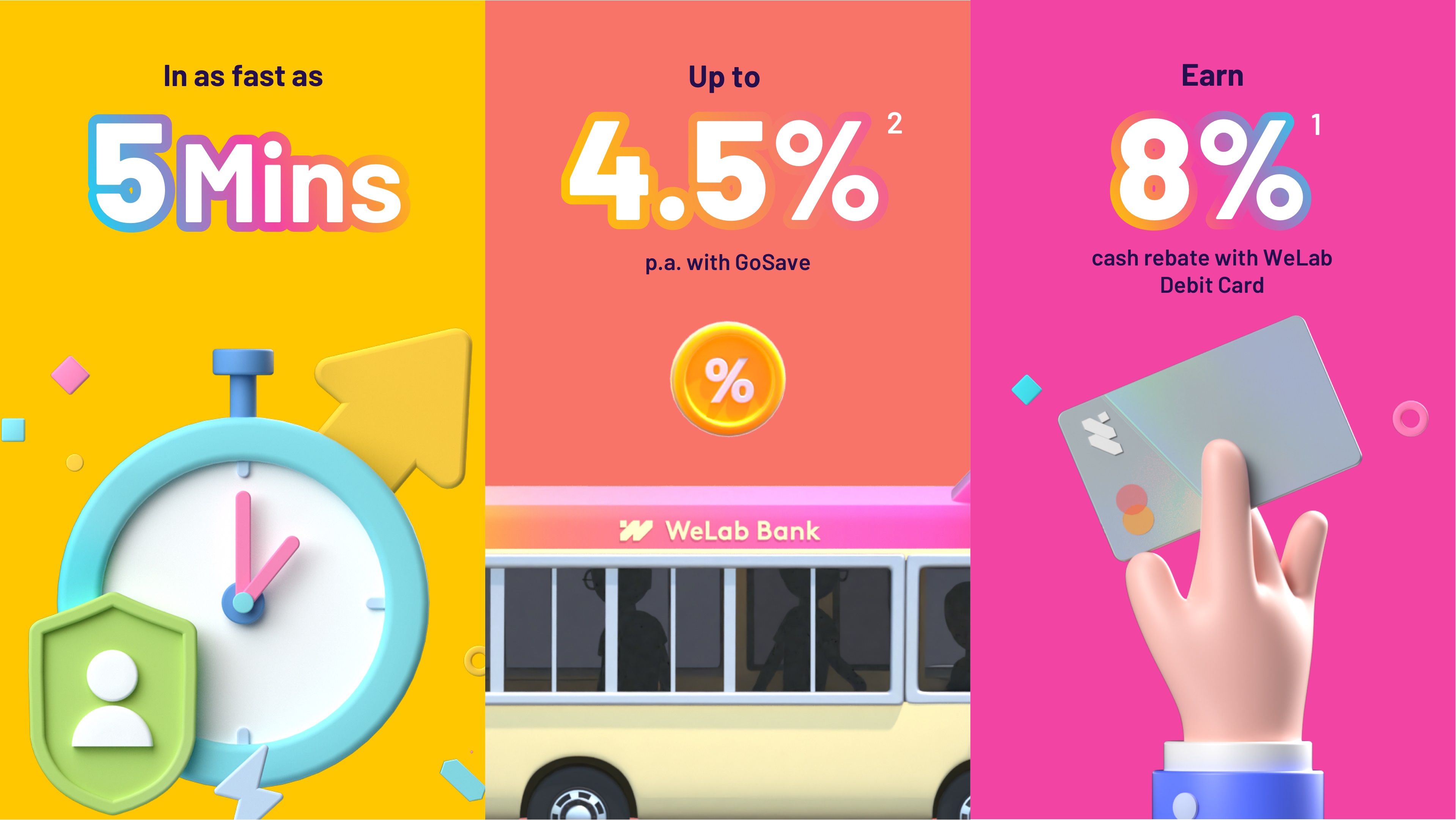

Customers can open an account in just five minutes with zero monthly fees. It says its debit card, the first numberless card to be publicly launched in the market, is being issued in collaboration with MasterCard.

The Hong Kong Monetary Authority has granted eight virtual banking licenses so far, although several of the license holders are still conducting trials prior to launching their services. WeLab secured its license on April 10 2019.

Chief executive Adrian Tse says: “The world has enough complexities and so we believe that managing your money should be simple and easy. Empowered by technologies built for the new normal, WeLab Bank was born from an initiative to re-imagine the banking experience for the 7.5 million people of Hong Kong. We have efficiently built WeLab Bank from scratch, free from any legacies, with innovative features that proactively help you to take control of your financial journey. Everything you need to do can be done simply from your phone.”

WeLab has also inaugurated GoSave, which it describes as “Hong Kong’s first savings product that harnesses the power of the community”. This means that the more customers join GoSave, the higher they can drive up the interest rate, for up to 4.5% per annum. Actually, 1.5% is the maximum eligible interest rate and 3% is the additional preferential interest rate. The interest rate boost is applicable to the first 10,000 customers within the promotion period and the maximum principal that is eligible for this interest rate boost is HK$50,000 (US$6,452) for a customer's first three-month time deposit. The interest rates are subject to change as per prevailing market conditions. GoSave users can start with as little as HK$10 deposit and can withdraw their funds at any time without additional fees for a maximum of two times during the tenor, says the bank.

WeLab’s debit card, on the other hand, can be used to make purchases in physical stores, shop online or withdraw cash from any JETCO ATM across the city. Through Mastercard, customers can gain access to millions of merchants globally, and even receive 8% cash rebate (capped at HK$3,000) during the promotion period on their spending .

“We see the physical WeLab card as a medium that enables the customers to perform different activities. You can use it as a debit card to access the ATM today but this is just the beginning to unlock endless possibilities, where it may also become the access card to the office, gym, carpark or even a credit card, all combined into one. The real power happens behind the scenes from the technology that powers the app on the mobile phone – that is the real remote control of the future,” says Tse.